Last week was interesting for anyone paying attention to the streaming world. And by that, I mean anyone who pays any attention at all to the entertainment industry these days, since that’s where all the action is. Even with the enormous success of Spider-Man: No Way Home, the theatrical model is still in a state of distress thanks to Omicron, and people are getting more and more used to enjoying their entertainment content from the comfort of their own couch.

I’ve discussed this a couple of times in recent weeks, primarily in regard to Disney+ and new Disney CEO Bob Chapek’s attitude about where the future of the industry lies, but recent developments have once again put the issue front and center, making it worth discussing yet again.

Two major events occurred last week that don’t initially seem directly connected but showcase a lot of what’s at stake here. Neither of them was terribly earth-shattering, but both were quite telling.

The first was prolific production shingle Skydance signing a major output deal with Apple. The second was Netflix stock taking a ferocious dive after news came out that the streamer’s new subscriber numbers had slowed to a crawl.

Let’s tackle Skydance first. David Ellison‘s company is big time, putting out blockbuster-sized movies and backing event television. In addition to Tom Cruise’s Mission: Impossible franchise and the upcoming Top Gun sequel, it’s also involved with Paramount’s Star Trek and Transformers franchises, plus it backed planned franchise starters Without Remorse starring Michael B. Jordan, The Tomorrow War starring Chris Pratt, and The Old Guard starring Charlize Theron. Skydance has several other notable film projects on the horizon, including Peter Farrelly’s Green Book follow-up starring Zac Efron, and the Chris Evans–Ana de Armas thriller Ghosted.

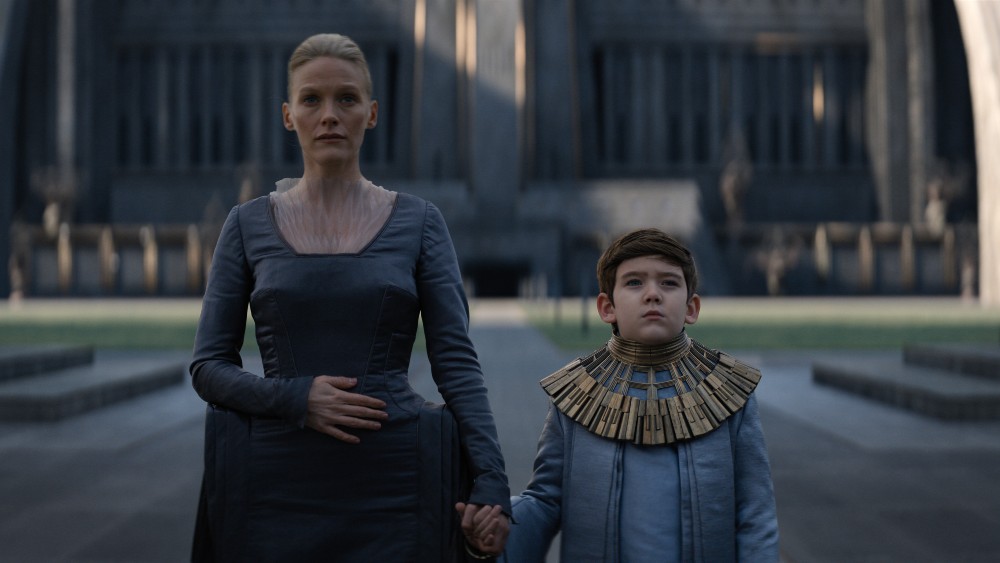

It has recently branched into TV, too, including the mammoth budgeted Foundation from David S. Goyer, and is now extending to interactive, animation, new media, and sports, making it a rather big fish for Apple to catch, one that will provide a torrent of original content for a streaming service in great need of such.

As noted, the deal gives Apple the content provider it desperately needs, while guaranteeing Skydance a solid streaming home for its projects, but it’s actually more important in terms of the larger picture of Hollywood, as it represents further proof that the days when studios would grant various creatives production deals and office space on the lot are long gone. The money for such expenditures just isn’t there anymore, especially since studios are only spending real money working on blockbusters.

There is a ton of money to be made on smaller films, but those movies are rarely getting made by studios because the margins aren’t high enough. I’m not going to get too deep into that at the moment, because it’s slightly off-topic here — seriously, I could give a dissertation on how studios could change their whole model and still make enormous amounts of money, not that they would listen — but I bring it up because the streaming services are where those movies are now getting made.

Know why? Because streamers don’t have to meet any release windows. They don’t have to worry about weekend grosses or theatrical competition, and they barely put anything at all into marketing, as they know people are going to open the app, where space on the homepage is invaluable. These streamers need to fill literally thousands of hours of content, which is why those overall deals that used to be on studio lots are now specifically given to the people who can give the streamers the constant stream of content they need in order to keep eyes on their service. It’s common sense, and it reinforces the notion that there has never been a better time in the history of the industry to be a content creator. With each new major streamer, another avenue is opened, so a company like Skydance can settle down with one suitor and rake in a lot of shekels while they’re at it.

The thing of it is, though, that a smaller operation can also make a solid deal and set itself up long-term, simply because of the laws of supply and demand. As of two years ago — I looked and couldn’t find more recent data — Netflix had 2.2 million minutes of content. That would mean that if you watched Netflix every minute of every day, you would consume the entirety of the library in a little more than four years. And that’s just Netflix. Add in all the other streaming services, and the numbers get even crazier, but because content is needed at all hours, every day, all over the country (and, increasingly, internationally as well), the beast keeps getting fed, and fed, and fed some more, with no end in sight.

Speaking of Netflix, there was that spectacular crash of its stock price on Friday. I mentioned above that this was not earth-shattering news, because it wasn’t. The only thing that surprised me was that it took this long to happen.

Netflix’s whole model is subscriber numbers. It takes on more and more debt, betting that the numbers will keep increasing. But since there is a limited number of people currently living on the planet, there are only so many potential new subscribers, and a lot of those are already watching Netflix because they’re using someone else’s login info, which makes them useless to the overall business model. Which means the whole thing is built, to some extent, on sand. That hasn’t stopped the company from becoming a monolith and driving the streaming wars, but this is definitely the first major chink in the proverbial armor. Yes, Netflix is still the biggest and the baddest, but that doesn’t mean it’s going to stay that way.

Apple’s deal with Skydance is a major step towards ensuring that it doesn’t. The advantage that Apple has over Netflix — the same advantage, incidentally, that is also owned by Amazon, HBO Max, Peacock, Paramount+, and, of course, Disney+ — is that its streaming service is not the engine that drives the company. Streaming is just one of many sources of revenue for these corporations, which finance these streamers with the gobs of money they’re making in other areas. Every time you buy a book or a vacuum cleaner on Amazon, you’re helping to finance the new season of The Marvelous Mrs. Maisel. With every new iPad, you’re putting money in Apple’s coffers, which now trickles down to Skydance and so on.

Netflix, meanwhile, is only about streaming. That’s the extent of its business model, and no matter how many hours of new content it creates each year (it spent $13.6 billion on programming last year), it’s not going to be anything more than that. Apple taking Skydance off the board means it’s yet another chess piece that Netflix can’t have, and as more pieces disappear, so will Netflix’s advantage over its rivals.

Netflix jumped out to a pretty enormous head start, but this race is far from over, and the other streamers are growing larger and larger in the company’s rearview mirror.

Neil Turitz is a journalist, essayist, author, and filmmaker who has worked in and written about Hollywood for nearly 25 years, though he has never lived there. These days, he splits his time between New York City and the Berkshires. He’s not on Twitter, but you can find him on Instagram @6wordreviews.

Neil Turitz is a journalist, essayist, author, and filmmaker who has worked in and written about Hollywood for nearly 25 years, though he has never lived there. These days, he splits his time between New York City and the Berkshires. He’s not on Twitter, but you can find him on Instagram @6wordreviews.

You can read a new installation of The Accidental Turitz every Wednesday, and all previous columns can be found here.