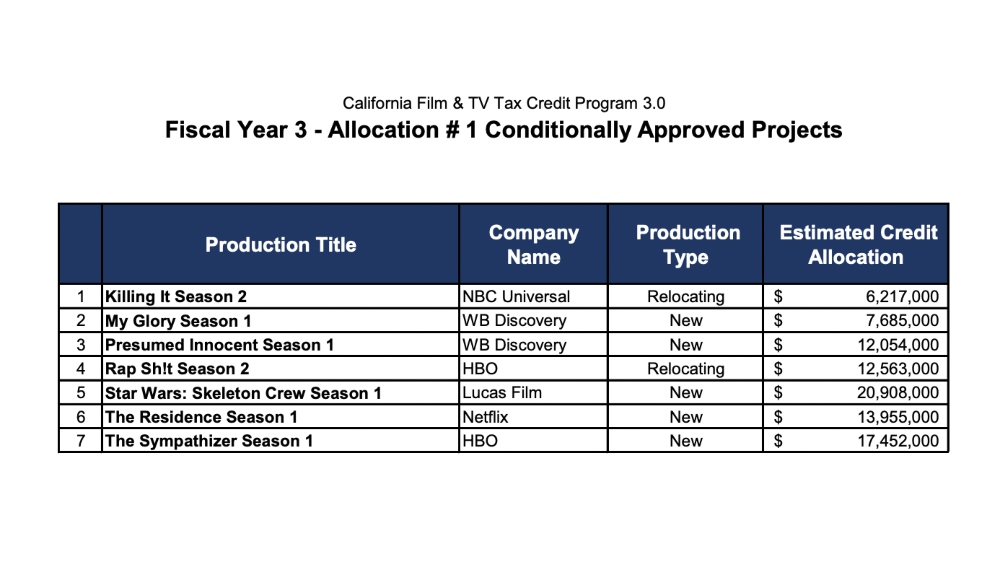

The California Film Commission has announced that five new series and two relocating series are among the projects selected for the latest round of tax credits — a direct result of Governor Gavin Newsom working with the state legislature to expand funding for California’s Film & Television Tax Credit Program.

The new series — Star Wars: Skeleton Crew (Lucasfilm), My Glory (WB Discovery), Presumed Innocent (WB Discovery), The Residence (Netflix), and The Sympathizer (HBO) — are the first new TV shows accepted into the tax credit program since 2019.

The absence of new TV series was due to the large number of recurring series already in the program. The most recent budget agreement, which received broad bipartisan support, increased funding for the tax credit program over a two-year period.

“Increased investment in our tax credit program strengthens California’s ability to compete and continue building on our status as the world’s media production capital,” said Colleen Bell, the Executive Director of the California Film Commission. “We are, once again, welcoming new TV series into the program, which creates jobs and economic opportunity here in the Golden State.”

The current round of tax credits also includes two relocating series — Killing It (NBC Universal) and Rap Sh!t (HBO) — which will move production from Louisiana and Florida, respectively. With these latest wins, California’s tax credit program has welcomed a total of 27 relocating TV series from other states and nations.

That list includes The Affair, The Flight Attendant, Hunters, In Treatment, The OA, Sneaky Pete, and You from New York; Chad, Legion, Lucifer, Mistresses, Mysterious Benedict Society and Timeless from Vancouver; American Horror Story, Killing It and Scream Queens from Louisiana; Ballers and Rap Shit from Florida; Good Girls and Promised Land from Georgia; ABC’s American Crime and Special from Texas; Veep from Maryland; Dream from New Jersey; Secrets and Lies from North Carolina; Miracle Workers from the Czech Republic; Penny Dreadful: City of Angels from Ireland.

Luke Del Treidici and Dan Goor, who serve as the writers, executive producers, and co-showrunners of Killing It, affirmed the tax credit program’s impact on their decision to relocate production from New Orleans to California.

“Killing It is a show about dreams coming true, so it’s only fitting we would pack up our bags and move to Hollywood,” Del Treidici said in a statement.

“We are thrilled to be making Season 2 in California, which not only has amazing crews and the best facilities but is also where our children are located,” added Goor.

In addition to the new and relocating series announced today, the tax credit program currently has 15 recurring (legacy) series accepted during previous allocation rounds and in various stages of production. That group included American Crime Story, The Dropout, Euphoria, Good Trouble, Mayans MC, The Orville, Perry Mason, The Rookie, S.W.A.T., Winning Time: The Rise of the Lakers Dynasty, Snowfall, Star Trek: Picard, This Is Us, Westworld, and Why Women Kill.

Obviously, some of these shows will now withdraw from the program because they’ve reached the end of their run, as is the case with This Is Us and The Dropout. Meanwhile, credit allocation will be issued to recurring TV series if/when they provide pickup orders for additional episodes of new seasons.

The seven new and relocating TV projects announced today are on track to spend a total of $713 million in California during their next season of production. Based on the information provided with each tax credit application, they will generate a combined $468.2 million in “qualified” spending (defined as wages to below-the-line workers and payments to in-state vendors).

Only the qualified portion of each project’s budget is eligible for tax credits under California’s uniquely targeted incentive program. This means that the projects announced today will generate about $245 million in spending that is not incentivized. The California Film Commission has reserved a total of $90.8 million in tax credit allocation for the seven projects.

The project with the largest qualified spend by far is Lucasfilm’s Star Wars: Skeleton Crew, which is on track for nearly $136 million in qualified expenditures during its first season. The new series comes to Disney+ in 2023 and follows a group of kids lost in the Star Wars galaxy who try to find their way home. It stars Jude Law and hails from executive producers Jon Watts, Chris Ford, Jon Favreau, Dave Filoni, Kathleen Kennedy, Michelle Rejwan, and Colin Wilson.

Together, the seven new and relocating series announced today will employ an estimated 1,953 crew, 545 cast, and 21,691 background actors/stand-ins (the latter measured in “man-days”) during their next season of production. They will spend an estimated 559 filming days in California, including 20 shoot days planned outside the Los Angeles 30-Mile Studio Zone. They will also generate significant post-production jobs and revenue for California VFX artists, sound editors, sound mixers, musicians, and other workers/vendors.

The California Film Commission received a total of 18 applications during the June 13-15 application period for TV projects. The list of conditionally approved projects is subject to change, as applicants may withdraw from the tax credit program and their reservation of credits reassigned to one or more projects on the waitlist.

The next application period for TV projects will be held Sept. 19-21. The next application period for feature films will be held July 18-20.

In case you need a history lesson, the California legislature passed a bill in 2014 that more than tripled the size of the state’s film and television production incentive, from $100 million to $330 million annually. Aimed at retaining and attracting production jobs and economic activity across the state, the California Film and TV Tax Credit Program 2.0 also extended eligibility to include a range of project types (big-budget feature films, TV pilots and one-hour TV series for any distribution outlet) that were excluded from the state’s first-generation tax credit program.

Program 2.0 also introduced a “jobs ratio” ranking system to select projects based on “qualified” spending (e.g., wages paid to below-the-line workers and payments made to in-state vendors). To spur production statewide, an additional five percent tax credit was made available to non-independent projects that shoot outside the Los Angeles 30-Mile Studio Zone or that have qualified expenditures for visual effects or music scoring/track recording. The five-year Program 2.0 went into effect on July 1, 2015 and wrapped its fifth and final fiscal year (2019-20) on June 30, 2020.

The third generation of the California Film and TV Tax Credit Program (dubbed “Program 3.0”) was launched on July 1, 2020. New provisions include a pilot skills training program to help individuals from underserved communities gain access to career opportunities. Program 3.0 also adds provisions requiring projects to have a written policy for addressing unlawful harassment and enhanced reporting of above and below-the-line cast and crew employment diversity data.

Meanwhile, Senate Bill 144, which was signed into law by Gov. Newsom on July 21, has several key provisions, including an additional $15 million per year (for two years) increase in tax credits reserved specifically for relocating TV series, bringing total annual funding for relocating series to $71.1 million (up from $56.1 million). In addition, the criteria to qualify as a relocating TV series has been relaxed to include series that filmed their pilot episode out-of-state (the tax credit program previously required relocating series to film an entire season out-of-state).

Click here for More information about California’s Film and Television Tax Credit Program 3.0, including application procedures, eligibility, and guidelines.