California’s Film & Television Tax Credit Program continues to welcome big-budget and independent films, including 24 new projects announced today. These films (21 independent, three non-independent) are on track to bring $662 million in total production spending to California, including an estimated $423 million in “qualified” expenditures (wages to below-the-line workers and payments to in-state vendors). They will employ an estimated 3,173 crew, 801 cast and 29,602 background actors and stand-ins.

Three of the projects announced today are big-budget films — an untitled Disney live-action project, MGM‘s latest remake of Thomas Crown Affair, and the Michael Jackson biopic, Michael, which is on track to generate more in-state spending than any other film in the tax credit program’s 14-year history. Combined, these the three big-budget projects will generate an estimated $265 million in qualified spending and $433 million in total spending in California.

In addition, the 21 independent films announced today will generate a combined $172 million in qualified spending and $230 million in total spending. The six indies with budgets over $10 million (Live, Puritan II, Shell, The Invite, The Knockout Queen, and Unstoppable) are on track to generate a combined $96 million in qualified spending and $128 million in total spending.

The 24 film projects will also generate significant post-production jobs and revenue for California visual effects artists, sound editors, sound mixers, musicians and other industry workers/vendors.

“Our tax credit program continues to welcome a diverse range of projects, from big-budget films to small independent projects, and everything in between,” said California Film Commission Executive Director Colleen Bell. “The program is an important tool for maintaining our competitiveness and curbing runaway production. We are working harder than ever to keep entertainment production here in California, where it belongs.”

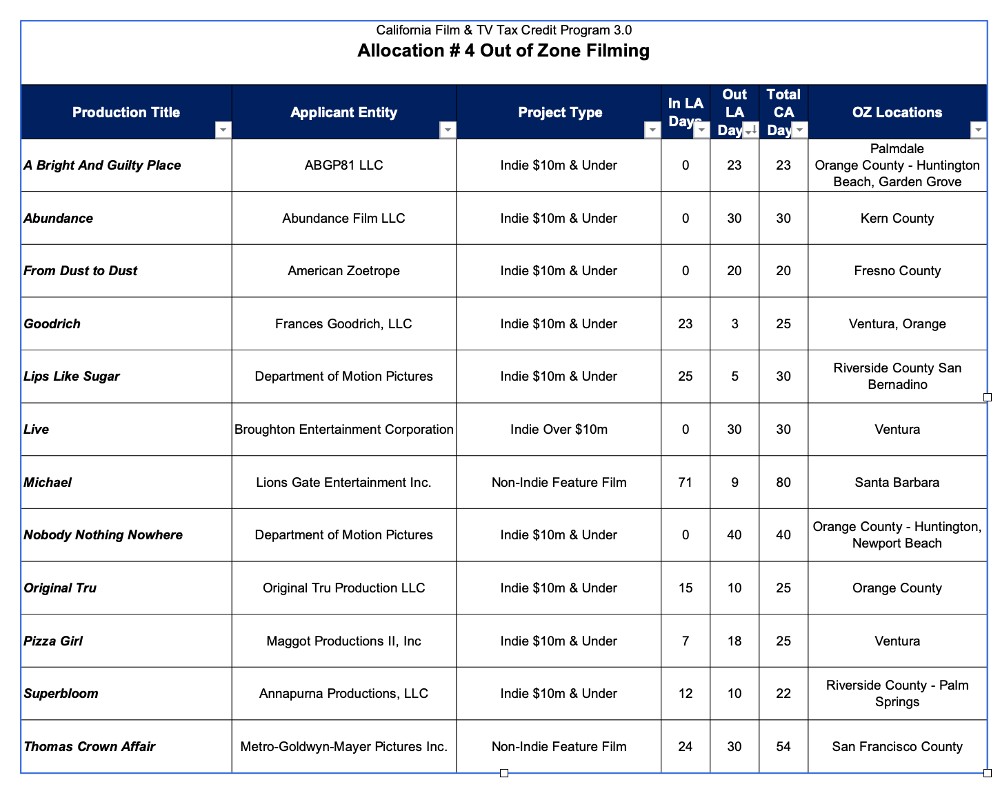

Production for the 24 projects is set to occur over a combined 768 filming days in California. Half of the projects plan to film outside the Los Angeles 30-Mile Studio Zone, for a combined 228 out-of-zone filming days (see “Allocation # 4 Out of Zone Filming” chart below).

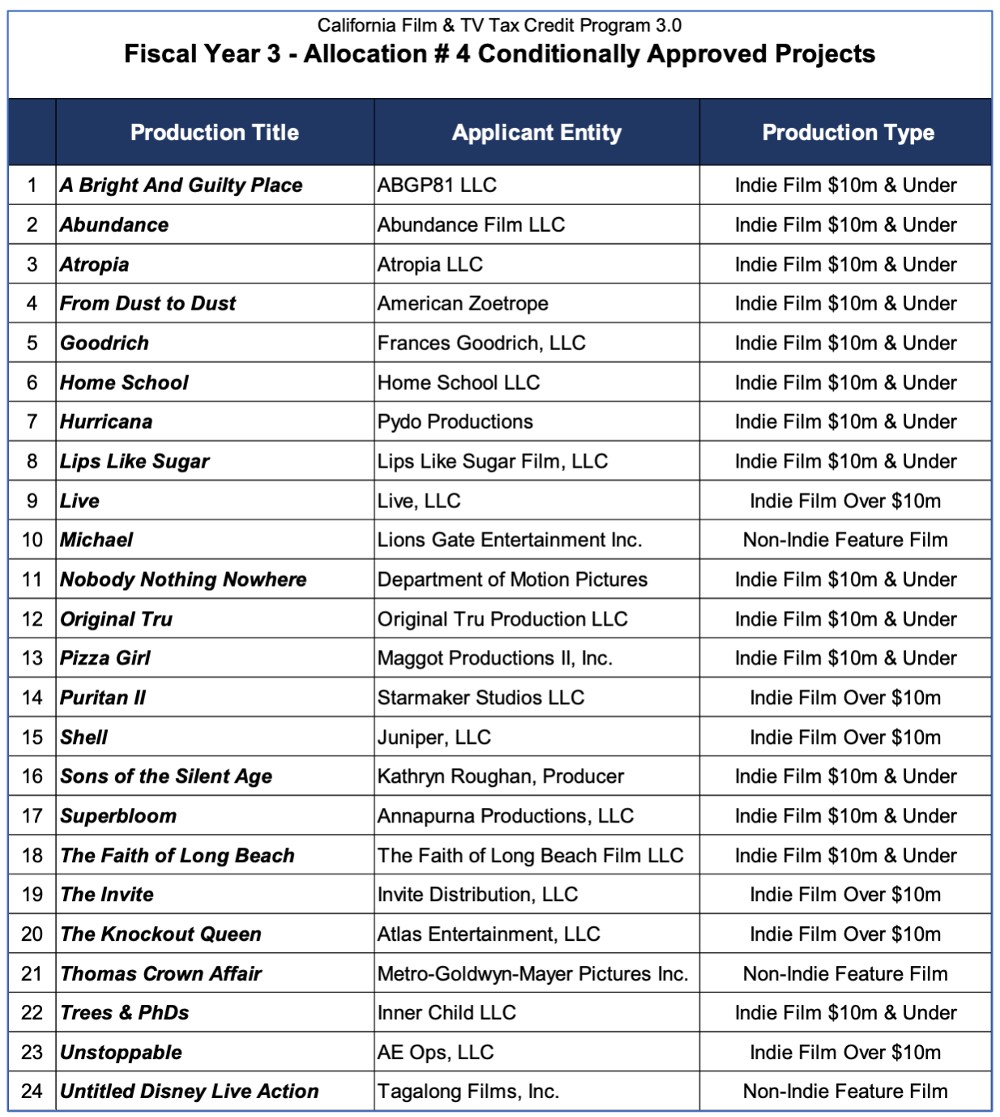

The California Film Commission received a total of 58 applications during the January 30 – February 6 feature film tax credit application period. It has reserved $81.7 million in tax credit allocation for the 24 conditionally approved projects (see “Fiscal Year 3 – Allocation # 4 Conditionally Approved Projects” chart below).

The next application period for feature films will be held July 24 – 31. The next application period for TV projects will be held March 6 – 20.

About California’s Film and Television Tax Credit Program

In 2014, the California legislature passed a bill that more than tripled the size of the state’s film and television production incentive, from $100 million to $330 million annually. Aimed at retaining and attracting production jobs and economic activity across the state, the California Film and TV Tax Credit Program 2.0 also extended eligibility to include a range of project types (big-budget feature films, TV pilots and 1-hr. TV series for any distribution outlet). The current third generation of the California Film and TV Tax Credit Program (dubbed “Program 3.0”) was launched on July 1, 2020.

More information about Program 3.0, including application procedures, eligibility, and guidelines, is available at http://www.film.ca.gov/tax-credit/.